Accounting Equation Basics, Example and Formula

For example, when a company is started, its assets are first purchased with either cash the company received from loans or cash the company received from investors. Thus, all of the company’s assets stem from either creditors or investors i.e. liabilities and equity. The income and retained earnings of the accounting equation is also an essential component in computing, understanding, and analyzing a firm’s income statement. This statement reflects profits and losses that are themselves determined by the calculations that make up the basic accounting equation. In other words, this equation allows businesses to determine revenue as well as prepare a statement of retained earnings. This then allows them to predict future profit trends and adjust business practices accordingly.

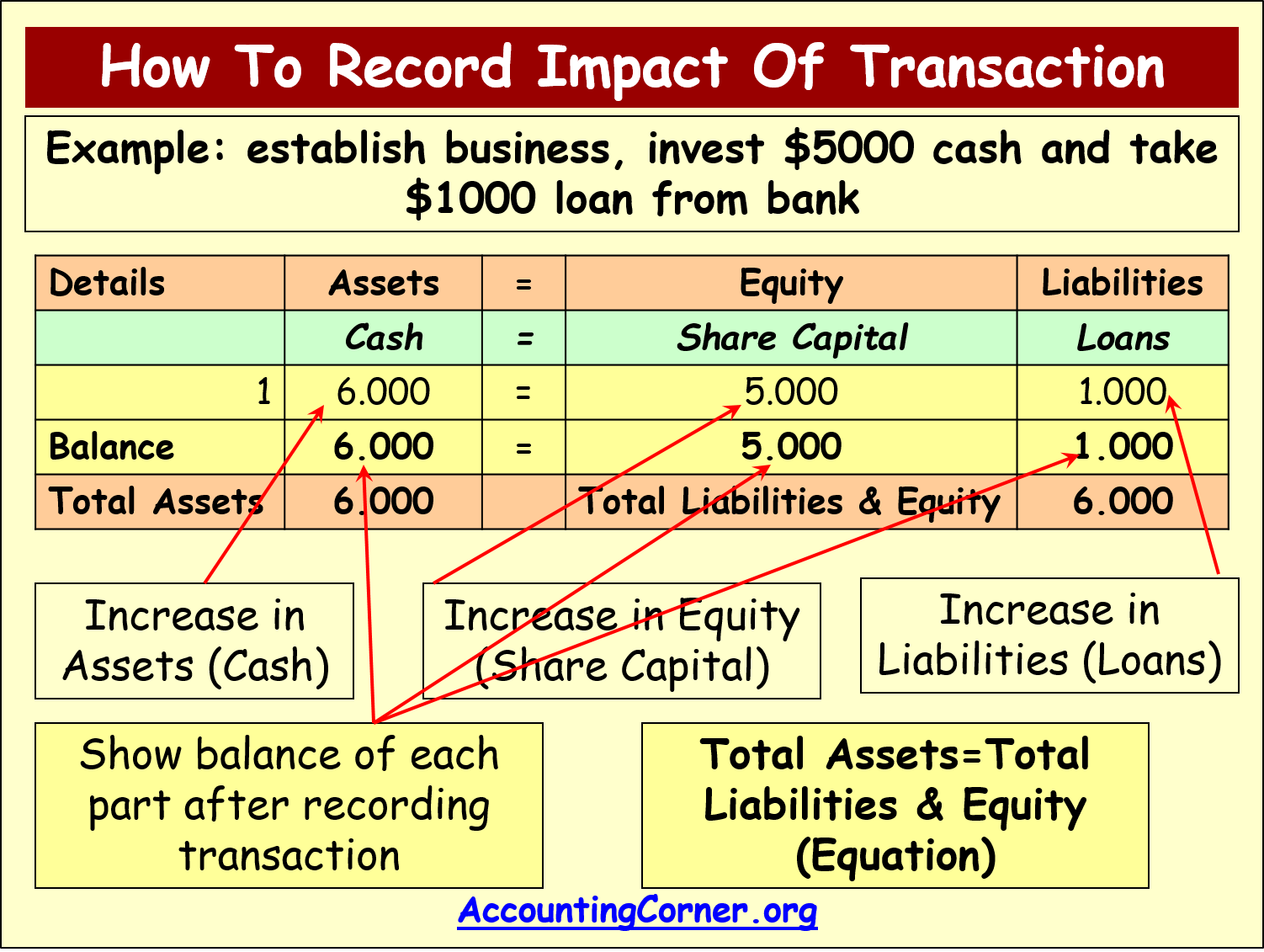

Total assets always equal total liabilities plus owner’s equity

That part of the accounting system which contains the balance sheet and income statement accounts used for recording transactions. After six months, Speakers, Inc. is growing rapidly and needs to find a new place of business. Ted decides it makes the most financial sense for Speakers, Inc. to buy a building. Since Speakers, Inc. doesn’t have $500,000 xero spruces up starter plan to help support small businesses in cash to pay for a building, it must take out a loan. Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage. This business transaction decreases assets by the $100,000 of cash disbursed, increases assets by the new $500,000 building, and increases liabilities by the new $400,000 mortgage.

Effects of Transactions on Accounting Equation

Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use. The major and often largest value assets of most companies are that company’s machinery, buildings, and property. These are fixed assets that are usually held for many years. Accounts receivable list the amounts of money owed to the company by its customers for the sale of its products. Assets include cash and cash equivalents or liquid assets, which may include Treasury bills and certificates of deposit (CDs). Suppose you buy a house for $200,000 with $120,000 in mortgage and $80,000 of your own money.

Great! The Financial Professional Will Get Back To You Soon.

In accounting, the claims of creditors are referred to as liabilities and the claims of owner are referred to as owner’s equity. Did you know that there are several names for this formula? Whether you call it the accounting equation, the accounting formula, the balance sheet equation, the fundamental accounting equation, or the basic accounting equation, they all mean the same thing.

- Debt is a liability, whether it is a long-term loan or a bill that is due to be paid.

- Metro Corporation paid a total of $900 for office salaries.

- The formula is more of a principle than a metric that yields significant insight.

- Alternatively, suppose the company decided to borrow $100 to buy the chair as opposed to using its own cash.

- Merely placing an order for goods is not a recordable transaction because no exchange has taken place.

Whatever value is left after the company pays the money it owes to banks, suppliers, and employees belong to the company owners. The accounting equation focuses on your balance sheet, which is a historical summary of your company, what you own, and what you owe. This transaction would reduce cash by $9,500 and accounts payable by $10,000. The difference of $500 in the cash discount would be added to the owner’s equity. On 12 January, Sam Enterprises pays $10,000 cash to its accounts payable.

Why must Accounting Equation always Balance?

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

A lender will better understand if enough assets cover the potential debt. In fact, most businesses don’t rely on single-entry accounting because they need more than what single-entry can provide. Single-entry accounting only shows expenses and sales but doesn’t establish how those transactions work together to determine profitability. On 5 January, Sam purchases merchandise for $20,000 on credit.

As you can see, all of these transactions always balance out the accounting equation. This equation holds true for all business activities and transactions. If assets increase, either liabilities or owner’s equity must increase to balance out the equation. Shareholder Equity is equal to a business’s total assets minus its total liabilities. It can be found on a balance sheet and is one of the most important metrics for analysts to assess the financial health of a company. The shareholders’ equity number is a company’s total assets minus its total liabilities.

If the net amount is a negative amount, it is referred to as a net loss. The third part of the accounting equation is shareholder equity. The revenue a company shareholder can claim after debts have been paid is Shareholder Equity. The accounting equation states that the amount of assets must be equal to liabilities plus shareholder or owner equity. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. On 22 January, Sam Enterprises pays $9,500 cash to creditors and receives a cash discount of $500. The difference between the sale price and the cost of merchandise is the profit of the business that would increase the owner’s equity by $1,000 (6,000 – $5,000).